If you’re in the market for a new or used car and considering financing options, you might be wondering, “How much car loan can I get?” Understanding your loan eligibility is crucial before you start shopping for a car.

In this article, we’ll break down the factors that determine how much car loan you can qualify for, helping you make informed decisions about your car buying journey.

Table of Contents:

- Understanding Loan Eligibility

- Income Assessment

- Credit Score Consideration

- Debt-to-Income Ratio Analysis

- Down Payment Requirement

- Loan-to-Value Ratio (LTV)

- Loan Pre-Approval Process

Understanding Loan Eligibility

When it comes to getting a car loan, your eligibility depends on several factors:

- Income: Lenders assess your income to determine your ability to repay the loan.

- Credit Score: A higher credit score generally leads to better loan terms and higher loan amounts.

- Debt-to-Income Ratio (DTI): Lenders consider your DTI ratio to evaluate your overall financial health.

- Down Payment: The amount you can put down upfront affects the loan amount you qualify for.

- Loan-to-Value (LTV) Ratio: Lenders use the LTV ratio to assess the risk of the loan compared to the car’s value.

Income Assessment

Your income plays a significant role in determining your loan eligibility. Lenders want to ensure that you have a stable source of income to repay the loan.

The higher your income, the more likely you are to qualify for a larger loan amount.

Credit Score Consideration

Your credit score is a crucial factor in loan approval. Lenders use your credit score to assess your creditworthiness and determine the interest rate on your loan.

A higher credit score indicates a lower risk for the lender, making you eligible for a larger loan amount with better terms.

Debt-to-Income Ratio Analysis

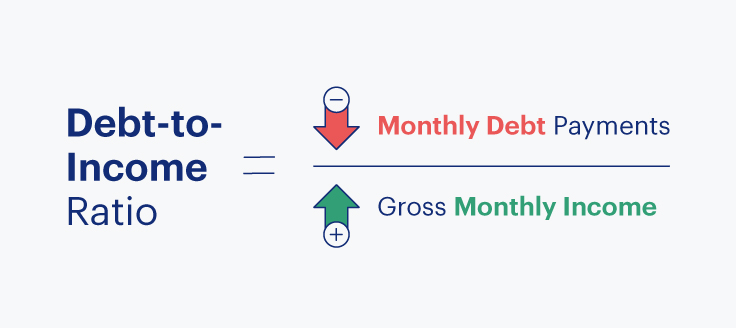

Lenders calculate your DTI ratio by comparing your monthly debt payments to your gross monthly income.

A lower DTI ratio signals to lenders that you have a manageable level of debt relative to your income, making you a more attractive candidate for a car loan.

Down Payment Requirement

The down payment you can afford impacts the loan amount you qualify for.

A larger down payment reduces the loan amount, making it easier to qualify for a higher loan amount with lower monthly payments.

Loan-to-Value Ratio (LTV)

The LTV ratio compares the loan amount to the value of the car. Lenders prefer lower LTV ratios to mitigate the risk of the loan.

A lower LTV ratio increases your chances of loan approval and may qualify you for a higher loan amount.

Loan Pre-Approval Process

Before you start shopping for a car, consider getting pre-approved for a loan.

Pre-approval allows you to know exactly how much you can borrow, giving you confidence and leverage when negotiating with dealerships.

Determining how much car loan you can get involves evaluating your income, credit score, DTI ratio, down payment, and LTV ratio.

By understanding these factors and getting pre-approved for a loan, you can shop for a car with confidence, knowing exactly how much you can afford.

Ready to explore your car loan options? Visit Car Galaxy, a car dealer in Thane, Mumbai, and let our experienced team help you find the perfect car within your budget.

Don’t settle for less – trust Car Galaxy for the best value and unbiased advice.